In addition to placing your pledge into the offering plate at church, the following options are suggested:

Mailed Checks

Payable to: St. Paul’s Episcopal Church

Mailed to: St. Paul’s, 3836 Flatiron Loop, Ste. 101

Wesley Chapel, FL 33544

Online “Bill Pay” Tool through Your Banking Institution

Using this function allows you to make a one-time gift, gifts at the time of your choosing or setup automatic payments, particularly helpful for pledges.

Save a check, save a stamp. Your bank will mail a paper check to the church. Here’s what you will need:

Name of Company/Institution: St. Paul’s Episcopal Church*

Address: 3836 Flatiron Loop, Suite 101, Wesley Chapel, FL 33544

Phone: 813-803-7489

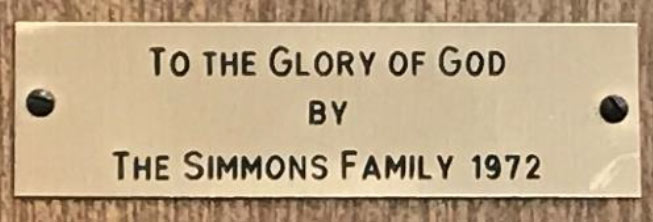

Designated donor gifts are items that are intended to be with the church across generations. Our stunning brass processional cross was our first designated donor gift in 2018. Our sister churches and the Tampa Deanery have generously gifted us our altar, reredos, the four new prie-dieux (prayer desks in the chancel), the new brass paschal candle stick and the basic “starter” altar and lectern hangings. Following is a registry of gifts for our new church in preparation for our first St. Paul’s Sunday (patronal feast day) on January 24, 2021 (the official re-launch to our Wesley Chapel Community). Most gifts in the registry have been placed in order of priority.

Special Contributions are contributions to one-time expenses which also have a long-term impact on the growth and life of the congregation.

Designated donor gifts may be made at any time, and may be given by multiple donors.

Please complete our Contact Form for inquiries.

Step One

Contact Mother Hymes to confirm that the item(s) you wish to gift have not already been gifted.

Step Two

Please accompany the check with a brief note (it can be typed or handwritten) which specifies your intent for the contribution (ex: I am/My spouse and I are making a special gift of (insert amount) to the new St. Paul’s Church in Wesley Chapel in donating the insert item(s). This will direct the funds to the line item in the budget called “Special Gifts/Donations.”

Step Three

Check Made to: St. Paul’s Episcopal Church WC

Check Memo: STP Special Gift (insert item)

Step Four

Mail To: St. Paul’s Episcopal Church

3836 Flatiron Loop, Ste. 101

Wesley Chapel, FL 33544

According to IRS tax rules for charitable deductions, donors must deliver checks on or by December 31 to qualify for a charitable contribution deduction for that year. Checks that are written, mailed and postmarked within the same year will be deductible for that year even if the church does not receive it until the following year.